Washington: WA HealthPlan Finder's preliminary 2026 report displays both the damage from ePTC expiration and the power of Premium Alignment

A couple of weeks ago, the Washington Health Benefit Exchange posted some basic info on their final 2026 Open Enrollment Period data:

OLYMPIA, Wash. – More than 290,000 Washingtonians selected a plan...

...40,000 fewer Washingtonians are receiving premium tax credits in 2026 than 2025. Some customers saw significant increases in their health insurance premiums, resulting in more than 61,000 customers changing their plans.

Customers also canceled their coverage more than any year prior — more than 28,000 in 2026 compared to just over 20,000 in 2025. Based on higher costs, it is expected that even more customers will disenroll before final counts are published in spring.

...Preliminary numbers show that more than 119,000 Washingtonians are receiving Cascade Care Savings and more than 188,000 are receiving federal premium tax credits.

The Exchange will not have the full picture of enrollment data until the spring as many people will drop coverage in the months to come. Customers have 30 days to pay their first premium and to make decisions about whether to continue to pay high premiums due to the expiration of ePTCs.

...During the 2025 Open Enrollment Period, 308,227 WA residents selected exchange policies, which means net enrollments are already down 5.9% y/y before any of the additional terminations noted above happen.

This week they published more comprehensive data, although it will still be awhile before the final report is available:

...While more than 290,000 Washingtonians selected or were automatically reenrolled into a qualified health plan (QHP) during open enrollment, this early number provides an incomplete picture. Final numbers will show significantly lower numbers as customers choose whether to pay their initial monthly premiums. Come spring, a reduction of 5–10% of current counts due to higher premiums is expected.

In 2025, there was a 7% decrease from last year’s preview report to the final numbers a few months later of 309,000 to 287,000. At that time, the enhanced premium tax credits (ePTCs) had not yet expired.

Federal policy changes have exacerbated an existing health care affordability crisis in Washington state. Nearly 39,000 fewer customers received advance premium tax credits during this open enrollment than last year. With the passage of H.R. 1 and the expiration of federal enhanced premium tax credits, many customers experienced a doubling or tripling of their premiums this year and faced hard decisions about whether or not to stay covered. Mitigation efforts — including Cascade Care Savings, the state premium assistance program, and premium alignment — have helped to reduce the effect of federal changes.

The actual report itself is fairly comprehensive, but it's also slightly irritating in that they round a lot of the numbers off to the nearest 10, 100 or 1,000, which makes sense in some cases but makes no sense at all in others.

In any event...

More than 290,000 Washingtonians are in a qualified health plan through Washington Healthplanfinder, compared to 309,000 during last year’s open enrollment. We anticipate a more than 10% decrease in plan selections in final reports due to federal changes.

Approximately 28,000 customers actively dropped their coverage during open enrollment alone — about 40% higher than last year. With federal changes, it was anticipated that customers would be more likely to drop health insurance due to affordability.

Nearly 39,000 fewer customers received premium tax credits in 2026 compared to 2025. Cascade Care Savings, however, had its highest number of recipients to date with 118,000, compared to the previous high of 115,000, helping to compensate for the APTC loss for some customers.

Approximately 67% of Washington Healthplanfinder customers are receiving premium tax credits and/or Cascade Care Savings, a 9% decrease from 2025. While fewer people qualify for premium tax credits, Cascade Care Savings has its highest number of recipients to date.

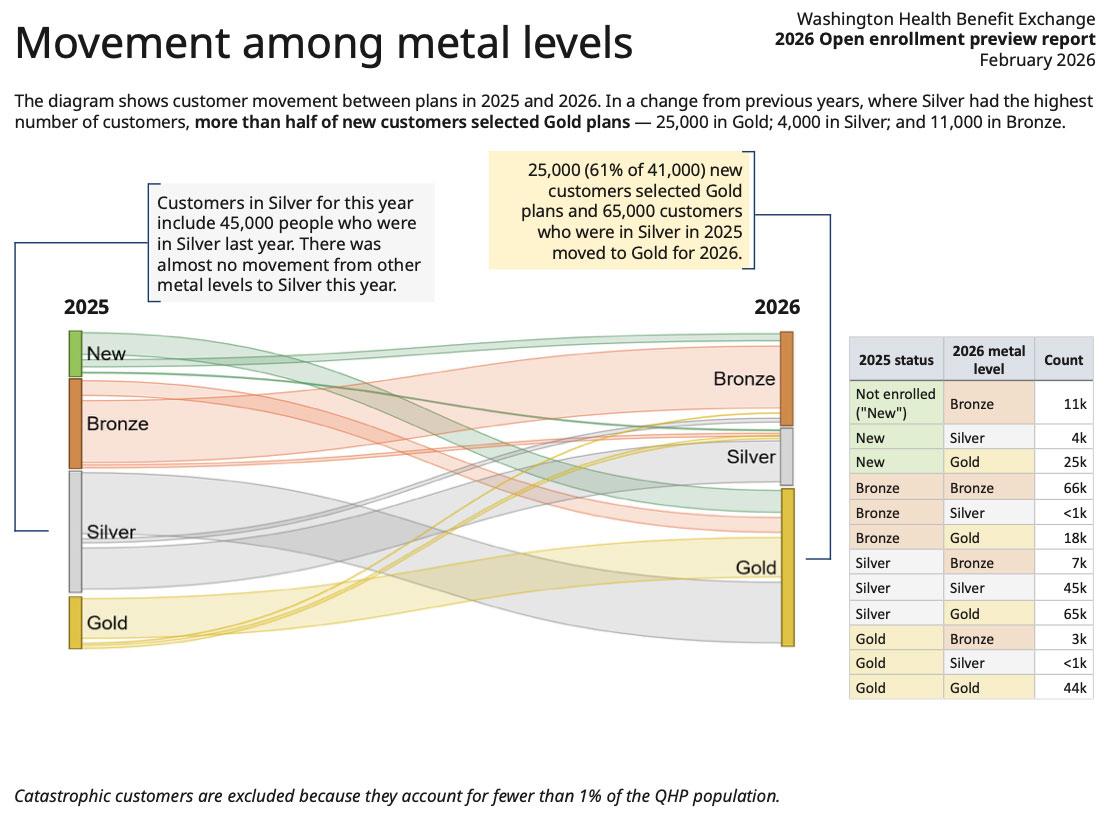

Most new* customers chose Gold plans. Open enrollment closed with 53% of customers in Gold plans. Approximately 44,000 returning customers stayed in Gold; 65,000 customers moved from Silver; and 18,000 customers moved from Bronze.

THIS LAST BULLET IS INCREDIBLY IMPORTANT; I'll discuss it further below.

- New Enrollment: 41,000 (down 16% y/y from 49,000 in 2025)

- Re-enrollees: 250,000 (down 4% y/y from 260,000 in 2025)

Loss of ePTCs appears to have resulted in higher drops than normal

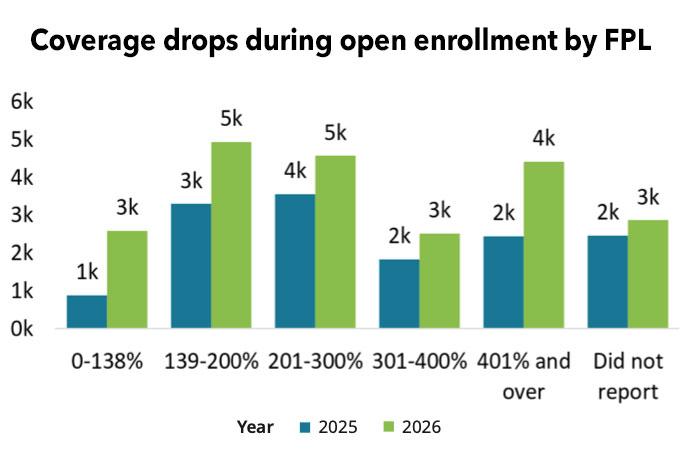

Because of the loss of federal enhanced premium tax credits, a higher number of customers to drop coverage during open enrollment this year than previous years. Drops were elevated across all federal poverty levels in 2026. Notably, the highest drops were in the 0–138% FPL category, where drops almost tripled. Another notable FPL category change was for people who made more than 400% FPL, who lost premium tax credits in 2026 and saw drops almost double over 2025.

During open enrollment, almost 28,000 customers actively dropped their health insurance; a 40% increase from 2025’s 20,000. When excluding the 6,000 people who moved to Apple Health, nearly 22,000 actually dropped coverage in 2026 compared to 14,000 in 2025 — a more than 50% increase in people who lost health insurance. In a typical year, there is a 5–10% decrease due to non-payment, evident by April 1. This year is likely to be higher.

...Federal enhanced premium tax credits expired on Dec. 31, 2025, raising net premiums nationwide. In contrast, Cascade Care Savings, state premium assistance, helped thousands of Washingtonians maintain their insurance for 2026.

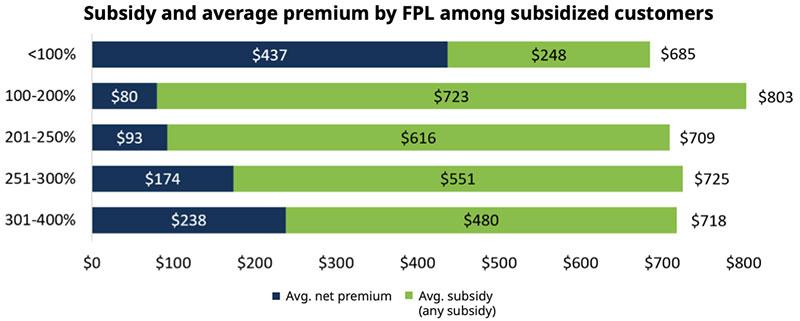

Approximately 39,000 fewer customers are receiving APTC in 2026 than in 2025. In 2025, over 12,000 people with incomes below 100% FPL received APTC; almost 24,000 people with incomes above 400% FPL received APTC. In 2026, both of these groups lost eligibility for premium tax credits.

...In 2026:

- 67% of Washington Healthplanfinder customers are in subsidized plans;

- 110,000 (38%) customers pay net premiums of $100 or less;

- 63,000 (22%) pay $25 or less; and

- 52,000 (18%) pay $10 or less.

Now we get into the most critical factor for Washington State: METAL LEVELS and PREMIUM ALIGNMENT:

Selections by metal level

For the first year ever, Gold plans were the most selected during open enrollment. The state increased the cost of Silver plans to help offset the loss of federal premium tax credits. This effort called premium alignment increased Silver plan premiums to increase the amount of monthly premium tax credits the majority of Washington Healthplanfinder customers rely on to afford their health insurance. Because of this, Silver plans went from being our most frequently selected plan in 2025 to the least selected in 2026.

- 2025 Plan Selections:

- 103,000 Bronze (33.4%)

- 148,000 Silver (48.1%)

- 57,000 Gold (18.5%)

- 2026 Plan Selections:

- 87,000 Bronze (30.1%)

- 50,000 Silver (17.3%)

- 152,000 Gold (52.6%)

For the first time ever, most new customers chose Gold plans. Washington State Office of the Insurance Commissioner enacted an emergency rule in March 2025 to protect health insurance affordability. The rule required Washington Healthplanfinder carriers to increase Silver costs to increase available tax credits. This made it so that Silver plans were no longer the best option for many customers with incomes outside of 100–200% FPL.

The last graph is actually very cool: It shows the power of Premium Alignment, especially in a state newly implementing it for the first time (there will likely be far less movement to Gold plans in 2027 and beyond since the Premium Alignment impact will already be baked in, as it already was in prior years in states like Texas, Pennsylvania, New Mexico, Maryland and so on).

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.